DUFU (7233) - Technical and Fundamental Analysis

- HONG WEI GIET

- Nov 17, 2019

- 2 min read

Technical Analysis

===============

- DUFU shares price completed a bottom consolidation with 150 trading days and break out the yellow box on Aug 19, 2019, after a huge volume appeared on July 10, 2019.

- It continues the upward trend and reached the historical high on Oct 16, 2019, which is before DUFU financial announcement Q32019.

- Ironically, an extraordinary trading volume appeared on Nov, 5 and Nov 6, 2019, with a sum of 14.659M on the respective trading days.

- Based on the technical analysis perspective, it is a red flag that reflects specific investors who are leaving DUFU counter.

- Therefore, we believe DUFU shares price will enter a huge retracement after 41 upward trading days.

- Resistance (2): RM 2.970

- Resistance (1): RM2.873

- Support (1): RM 2.683

- Support (2): RM 2.530

Fundamental Analysis

==================

- Based on DUFU financial summary, there are not many weakness points.

- It is a growing company and supported by the current trend.

- If you are a speculator, you can try to enter DUFU counter after a retracement.

- However, it is not a good counter for dividend collector due to DY lower than the sum of fixed deposit interest 3% and inflation rate, 4%.

- Based on the financial statement Y2018, corporate values shows RM2.9071

Latest 4Q Performance

===================

- If we compute the latest financial result in the past 4 quarters, we noticed that DUFU company performance unable to outperform last year.

- EPS/ROC/Profit margin/ROE is deteriorating as well.

- So we need to be careful if we enter the counter at high-level pricing.

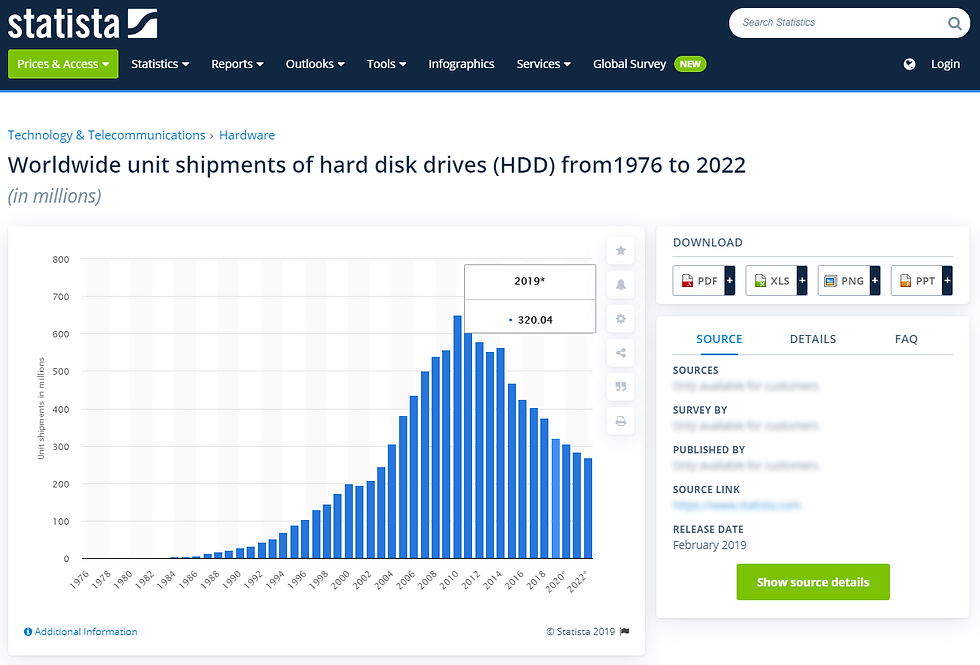

- Revenue/EBIT recorded a very good result in Y2018 majorly contributed by higher sales of Hard Disk Drive ("HDD")

- Depreciation of MYR and/or appreciation of USD in Y2018 have a positive impact on DUFU revenue as well because major of their sales dominated in USD.

- The bigger question is do DUFU able to improve its business performance in the future?

- Based on Statista forecast, WW unit shipments of HDD are declining in a fast phase. There is a reduction of 14.8% from Y2018 to Y2019.

- Higher demand for Solid-state drive ("SSD") also impact HDD sales as well.

- So we have a doubtful about DUFU company performance in next 5 years.

Comentários