AIRASIA (5099) - Technical & Fundamental Analysis

- HONG WEI GIET

- Feb 9, 2020

- 1 min read

Updated: Feb 15, 2020

Technical Analysis

=============

- After AIRASIA declared 90 cents dividend, there was a big gap down from RM2.85 to RM1.99 on Jul 29, 2019. It is a good lesson for a dividend investor. Win a candy, loss whole candy house.

- For sure, airline service industry is cyclical industry which is majorly affected by oil price movement and high operation cost with low profit margin. Thus, it is suitable for speculation only.

- Based on vertical volume charting, we notice that there is a huge volume level at RM1.225 so the shares must trade above RM1.225 to maintain upward momentum.

- There was 2 gap down at RM1.350 and RM1.520 respectively but they are week resistance with consideration of trading volume.

- With lower low trading volume (Feb 5, 2020 - Feb 7, 2020), we believe AIRASIA shares will enter a consolidation phrase soon and investor will wait for upcoming earning report Y2020.

- Resistance (1): RM1.650

- Resistance (2): RM1.490

- Support (1): RM1.235

- Support (2): RM1.150

Fundamental Analysis

=============

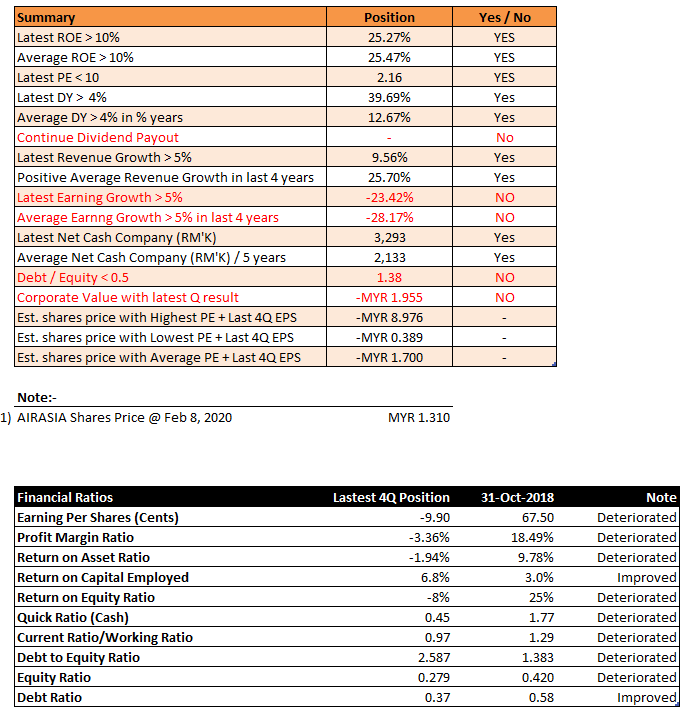

- Based last Q4 quarter results and Y2018 financial report, we suggest that value investor to stay away from AIRASIA counter.

- There is no any signs which shows AIRAISA Y2019 financial able to bit previous year performance.

- Ironically, lower oil price movement also unable to lead AIRASIA financial performance in Y2019 as well.

- Every re-bounce is a good exit point for existing shareholders which cap at higher price entry.

Comments